The restaurant industry is currently navigating a period of dynamic transformation, characterized by an impressive surge in strategic growth initiatives and customer-centric innovations. A comprehensive analysis of recent market activities reveals a clear and concerted effort by brands, spanning from beloved regional concepts to established national powerhouses, to aggressively expand their footprint and deepen their connection with consumers. This momentum is not arbitrary; it is built upon a sophisticated, multi-pronged strategy that intertwines significant capital investment, targeted market penetration through franchising, and the fortification of executive leadership teams. Concurrently, restaurants are deploying a constant stream of fresh menu offerings and compelling promotional campaigns designed to capture consumer attention and drive sales, particularly during the fiercely competitive holiday season. This confluence of strategic expansion and tactical engagement paints a vivid picture of a sector that is not merely recovering but is actively and confidently building its future.

Fueling Expansion Through Strategic Partnerships

Private Equity and Large-Scale Franchising

A primary catalyst behind the recent wave of ambitious expansion is the strategic infusion of private equity capital, which is enabling promising regional brands to transition onto the national stage. A prominent example of this trend is the significant investment secured by Sicilian Oven, a Florida-based polished casual Italian concept, from Goode Partners. This partnership was explicitly forged to provide the financial firepower and strategic guidance necessary to scale the brand from a local favorite into a nationwide chain. Such collaborations are about more than just funding; they represent a powerful endorsement of a brand’s potential and often come with invaluable expertise in areas crucial for growth, including supply chain optimization, advanced marketing analytics, and sophisticated real estate acquisition strategies. By leveraging private equity, emerging restaurants can overcome the substantial capital barriers to entry in new markets, allowing them to accelerate their growth timeline and compete more effectively against larger, more established players in the industry.

With capital secured, franchising emerges as the predominant vehicle for executing rapid and widespread market penetration. This model allows brands to expand their presence significantly without incurring the full capital cost of opening company-owned stores. A landmark example is the 25-unit franchise agreement announced by Angry Chickz, a California-based concept specializing in Nashville Hot Chicken. This deal is strategically designed to establish a strong foothold in the new and burgeoning markets of Texas and New Mexico, with a specific focus on major metropolitan areas like Dallas–Fort Worth and Albuquerque. This targeted approach ensures that new locations are situated in high-density areas with favorable demographics, maximizing the potential for immediate success. The franchising model empowers local entrepreneurs to drive growth, leveraging their intimate knowledge of the community while adhering to the brand’s established operational standards, creating a symbiotic relationship that fuels swift and sustainable expansion across the country.

Activating New Markets and Models

In concert with large-scale development deals, a key strategy involves the methodical and deliberate entry into previously untapped markets, diversifying a brand’s geographic portfolio and capturing new customer segments. The fast-casual concept Crave Hot Dogs & BBQ exemplifies this approach with its official launch into New Mexico through a new franchise signing in the city of Albuquerque. This type of strategic move is critical for long-term growth, as it reduces dependence on any single regional economy and opens up fresh revenue streams. Successfully entering a new state requires extensive due diligence, including a thorough analysis of local consumer tastes, a deep understanding of the competitive landscape, and the establishment of robust supply chain logistics. By carefully selecting new territories, brands can introduce unique dining options to underserved areas, quickly building a loyal customer base and establishing a strong foundation for future expansion within that region, effectively turning a single new location into a strategic beachhead.

Beyond simply expanding where they operate, innovative restaurant brands are also reimagining how they franchise, creating new models designed to attract a broader and more diverse pool of entrepreneurial talent. Himes Breakfast House, a Florida-based brunch concept, is at the forefront of this trend with the introduction of its “lifestyle-friendly” ownership model. This unique approach is engineered to address one of the most significant deterrents for potential franchisees: the notoriously long hours and demanding lifestyle associated with restaurant ownership. By offering a business model that provides a better work-life balance, Himes Breakfast House creates a powerful and distinctive selling proposition in a crowded marketplace. This strategy not only makes franchise ownership more accessible and appealing but also has the potential to foster higher franchisee satisfaction and lower turnover, which are essential components for maintaining brand consistency and achieving sustained, healthy growth over the long term.

Deepening Market Presence and Embracing Innovation

Strategic Densification in Key Regions

While breaking into new territories is a clear sign of growth, many established brands are simultaneously executing a strategy of market densification, which involves deepening their presence within existing, proven regions. Ono Hawaiian BBQ is actively pursuing this strategy with a significant expansion in Southern California, adding six new locations throughout San Diego County. The rationale behind this approach is sound: it allows the brand to capitalize on its existing name recognition, high customer demand, and established supply chain efficiencies. Moreover, this expansion includes the integration of modern consumer conveniences, most notably the addition of drive-thrus. This adaptation is critical in the contemporary fast-casual landscape, as it directly addresses the customer’s need for speed and convenience. Densification is not merely about increasing the number of stores; it is about making the brand more accessible and convenient for its loyal customer base, thereby solidifying its market-leading position and creating a formidable barrier to competitors.

Further illustrating the power of this focused growth strategy, Nick the Greek is also expanding its footprint in the same Southern California region, opening a new restaurant in Northern San Diego County’s 4S Ranch. This move highlights a nuanced aspect of densification: targeting specific, high-growth suburban communities to serve an existing and appreciative audience. Unlike entering a new state, which carries inherent risks and requires building brand awareness from scratch, this type of infill expansion leverages a pre-existing fan base. By strategically placing new locations in areas where demand outstrips supply, brands can enhance customer loyalty and increase the frequency of visits. This method of growth is highly efficient, often yielding a faster return on investment and strengthening the brand’s overall market share in its most important territories, effectively turning a core market into an impenetrable stronghold of brand dominance.

Leveraging Technology and Niche Locations

The evolution of restaurant expansion is also marked by an increasingly sophisticated approach to location selection and format innovation, tailoring each new outlet to its specific environment. For instance, Konala, a concept focused on healthy fast-food, recently secured its first-ever drive-thru location in Belleville, New Jersey, a format essential for success in a suburban, car-dependent market. In contrast, the counter-culture sandwich shop Cheba Hut “Toasted” Subs chose to open its newest store in the dense, walkable neighborhood of Uptown Minneapolis, where foot traffic is paramount. These decisions reflect a departure from a rigid, one-size-fits-all expansion model. Instead, successful brands are demonstrating a deep understanding of local market dynamics, recognizing that the optimal restaurant format—whether it’s a sprawling location with a drive-thru, a compact urban storefront, or a delivery-focused ghost kitchen—is dictated by the unique characteristics of the community it aims to serve.

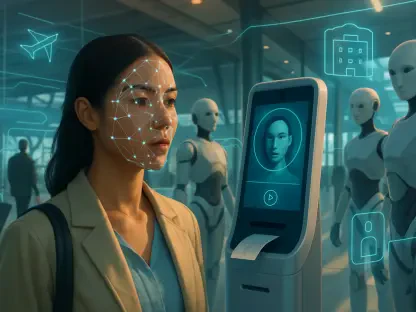

At the cutting edge of this evolution is the strategic deployment of technology to capture customers in non-traditional, high-traffic venues where a full-scale restaurant would be impractical. White Castle has provided a compelling glimpse into this future with its deployment of a fully automated kiosk in Terminal A of Boston Logan International Airport. This innovative move showcases how automation can overcome the dual challenges of limited physical space and high labor costs. By leveraging technology, White Castle can serve its iconic sliders to a captive audience of travelers around the clock, generating revenue from a previously inaccessible location. This represents a paradigm shift in thinking about what constitutes a “location,” opening the door for brands to establish a presence in transportation hubs, stadiums, university campuses, and other high-density areas, fundamentally reshaping the boundaries of the modern restaurant footprint and pushing the industry toward a more flexible and tech-integrated future.

A Retrospective on Strategic Positioning

The industry’s recent activities painted a clear picture of a sector focused on intelligent, forward-looking growth. The aggressive expansion efforts, fueled by both private equity and strategic franchising, were not merely about planting flags in new territories; they were calculated moves to build national brands with sustainable foundations. The simultaneous focus on market densification in core regions demonstrated a sophisticated understanding of brand loyalty and competitive positioning. Underpinning these physical expansions were crucial investments in human capital, as seen in the strategic appointments of seasoned executives at companies like GoTo Foods, Layne’s Chicken Fingers, and Golden Chick. These leadership changes were recognized as essential prerequisites for successfully navigating the complexities of large-scale growth. Furthermore, the constant churn of menu innovation and targeted holiday promotions from brands like Chipotle, Krystal, and JINYA Ramen Bar underscored a deep commitment to customer engagement. These initiatives were not isolated tactics but were integral parts of a holistic strategy that balanced long-term expansion with the immediate need to drive sales and maintain consumer relevance in a competitive marketplace. This period was defined by a multi-pronged approach that integrated capital, leadership, and customer-facing creativity to build resilient and thriving restaurant enterprises.