The monumental sale of the 607-room InterContinental New York Times Square hotel represents far more than a simple change of hands; it heralds a transformative new era for a property that has long been a fixture of the city’s hospitality scene. The deal, orchestrated by a new consortium of industry heavyweights, signals a pivotal moment for a cornerstone asset in one of the world’s most competitive markets.

This acquisition is widely interpreted as a powerful vote of confidence in the sustained recovery of New York’s high-end tourism and business travel sectors. At a time when market dynamics are under constant scrutiny, a transaction of this magnitude sends an unambiguous message about the long-term value proposition of prime Manhattan real estate. It counters narratives of a slow urban rebound, asserting that sophisticated capital is ready to make significant, long-term commitments.

The new ownership has outlined an ambitious vision that extends beyond a mere refresh, promising a complete operational and physical overhaul. This strategy involves not only a top-to-bottom renovation of the hotel’s physical spaces but also a fundamental restructuring of its management model, aiming to unlock new value and elevate the guest experience to compete at the highest echelon of the city’s luxury offerings.

Deconstructing the Deal Strategy Vision and Market Confidence

The Power Trio Behind the Acquisition and a New Operational Blueprint

The venture is backed by a formidable consortium, each bringing distinct expertise to the table. The new ownership group comprises Gencom, a global real estate investment firm known for its luxury portfolio; Argent Ventures, a seasoned real estate investment and development firm; and Highgate, a dominant hotel management and investment company. This power trio structure is designed to leverage Gencom’s investment acumen, Argent’s development experience, and Highgate’s operational prowess.

A cornerstone of the new strategy is a pivotal shift in the hotel’s operating structure. The property will transition from being directly managed by IHG to an IHG franchise, a move that places day-to-day operations squarely in the hands of Highgate. This transition to a franchise-plus-expert-operator model is a sophisticated maneuver aimed at combining the global distribution power of the InterContinental brand with the specialized, on-the-ground management efficiency that Highgate is known for, particularly within the New York market.

Forging a New Identity Inside the Multi-Million Dollar Renovation Plan

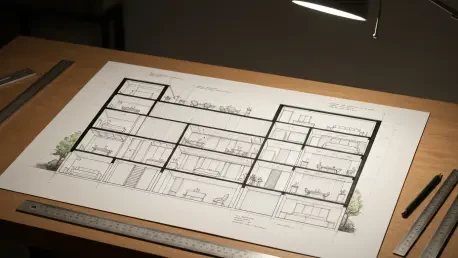

At the heart of the new vision is a transformative, multi-million dollar renovation set to touch every aspect of the property. The announced plans detail a comprehensive overhaul of all 607 guestrooms, the lobby and public spaces, and the hotel’s food and beverage outlets. This is not a superficial update but a strategic reimagining of the hotel’s identity.

This targeted capital investment is engineered to reposition the InterContinental, allowing it to compete more aggressively with the city’s premier luxury hotels. The goal is to capture a higher-end clientele by creating a product that meets and exceeds the elevated standards of modern luxury travelers. However, such a large-scale project carries inherent risks, requiring precise execution to deliver returns in a market already saturated with high-quality competitors.

A Bullish Bet on the Big Apple’s Hospitality Rebound

Industry observers see this acquisition as a leading indicator of renewed investor optimism in the foundational strength of the New York City hotel market. It represents a bullish, long-term bet on the city’s enduring appeal as a global hub for both leisure and corporate travel, suggesting that institutional capital is looking past short-term uncertainties.

The transaction fits squarely within a broader trend of significant capital flowing back into prime hospitality assets in major urban centers. It challenges any lingering doubts about the vitality of the city’s recovery, demonstrating that sophisticated investors are actively seeking opportunities to acquire and reposition large-scale assets, confident in their future performance.

Strategic Synergy How the InterContinental Deal Cements Each Partner’s NYC Foothold

For Gencom, this acquisition marks a significant expansion, representing its second major hotel purchase in New York within 18 months and its first foray into the InterContinental brand. This addition diversifies its luxury portfolio, which already includes prestigious brands like Ritz-Carlton and Four Seasons, and deepens its investment footprint in a key global market.

Meanwhile, the deal further solidifies Highgate’s deep-rooted dominance as a premier operator and investor across New York City. By taking over management, Highgate not only adds a landmark property to its portfolio but also reinforces its reputation as the go-to operator for complex, large-scale hotels in the city. The transaction also highlights the successful and recurring partnership between Argent Ventures and Highgate, who previously collaborated on the nearby Hyatt Regency Times Square, underscoring a focused and proven investment thesis centered on high-potential Times Square properties.

Key Takeaways for the Modern Hospitality Investor

The core of this transaction rests on three strategic pillars: the formation of a powerhouse partnership with complementary expertise, a fundamental overhaul of the management model, and a massive reinvestment in the physical product. This multi-pronged approach provides a blueprint for unlocking value in an established but under-optimized asset.

From an investment perspective, this deal suggests that successful asset repositioning in a top-tier market demands a bold, capital-intensive strategy focused squarely on elevating the guest experience. Furthermore, the franchise-plus-expert-operator model is presented as a highly effective approach for maximizing the potential of globally branded hotel assets, blending brand recognition with specialized operational agility.

The InterContinental’s Transformation as a Bellwether for New York’s Luxury Hotel Scene

Ultimately, this project is more than a simple renovation; it is a strategic repositioning designed for a new era of urban travel. The new owners are betting that modern luxury is defined by a seamless blend of brand prestige, exceptional physical environments, and hyper-efficient, locally attuned management.

The sheer scale of this overhaul was expected to create a ripple effect, potentially sparking further investment and redevelopment in other large-scale Times Square hotels. The move signaled that legacy properties required significant capital to remain competitive. The future performance of the InterContinental ultimately served as a crucial indicator of the evolving standards and competitive dynamics that would define urban luxury hospitality for years to come.