I’m thrilled to sit down with Katarina Railko, a renowned expert in the hospitality industry with a wealth of experience in travel, tourism, and entertainment. With her deep knowledge of market trends and a passion for events and conferences, Katarina offers invaluable insights into the evolving landscape of hotels and guest experiences. Today, we’ll dive into Marriott International’s third-quarter performance for 2025, exploring their financial outcomes, strategic growth through conversions and pipeline expansion, the rise of luxury demand, and innovative new offerings like the Outdoor Collection. Let’s uncover what’s driving the industry forward and how Marriott is positioning itself for the future.

Can you walk us through the standout aspects of Marriott’s third-quarter performance in 2025?

Absolutely, Olivia. Marriott’s Q3 results for 2025 showed a modest worldwide RevPAR increase of 0.5% year over year, which is a positive sign despite some regional challenges. What really caught my eye was the 2.6% growth in international markets, highlighting strong demand outside North America. However, the U.S. and Canada saw a slight decline of 0.4%, which dragged down the overall figure. This mixed performance reflects how global travel trends are diverging, with international travelers fueling growth while domestic markets face some headwinds.

What do you think contributed to the RevPAR decline in the U.S. and Canada during this quarter?

The dip in the U.S. and Canada can largely be traced to weaker demand in the lower chain scales. A significant factor was the reduction in government travel, which often supports these segments with consistent bookings. Beyond that, there’s been a general softness in demand for more budget-friendly accommodations, possibly due to economic pressures on certain traveler demographics. It’s a reminder that not all market segments recover at the same pace, and domestic challenges can sometimes overshadow international gains.

Despite this regional dip, Marriott maintained its full-year 2025 RevPAR growth outlook at 1.5% to 2.5%. What’s behind their confidence in sticking to this forecast?

Marriott’s confidence stems from their strong international performance and a diversified portfolio that balances out weaker areas. They’re likely banking on continued growth in markets outside the U.S. and Canada, where travel demand remains robust. Additionally, their focus on higher-performing segments like luxury, which saw a 4% RevPAR increase this quarter, helps offset domestic softness. I believe they’re also strategically positioning resources to tap into emerging travel trends and markets to maintain that growth trajectory.

Marriott’s development pipeline reached a record of nearly 4,000 properties and over 596,000 rooms. Can you share more about what’s driving this impressive expansion?

This pipeline is a testament to Marriott’s aggressive growth strategy. They’re focusing on a mix of new builds and strategic acquisitions, with over 250,000 rooms already under construction. The expansion is likely driven by high-demand regions, particularly in international markets where travel is booming, as well as untapped areas with growing tourism potential. They’re also diversifying their property types to cater to different traveler needs, from urban centers to leisure destinations, ensuring they capture a wide range of demand.

Conversions accounted for about 30% of signings and openings in the first nine months of 2025. Why do you think Marriott is placing such a strong emphasis on conversions right now?

Conversions are a smart move for Marriott because they allow for faster portfolio growth compared to ground-up construction. By rebranding existing properties, they can quickly expand their footprint with lower capital investment and shorter timelines. It’s also a way to penetrate competitive markets where new builds might face zoning or cost barriers. Conversions often work well with mid-tier and boutique brands, especially in markets with a lot of independent hotels looking to join a larger network for better visibility and resources.

Let’s talk about the new Outdoor Collection by Marriott Bonvoy brand. How do you see this fitting into their overall strategy?

The Outdoor Collection is a brilliant addition, targeting travelers seeking nature-centric experiences near national parks, deserts, and ski areas. It’s aimed at adventure seekers and families who value design-forward accommodations in scenic locations. This move taps into the growing trend of experiential travel, where guests prioritize unique, destination-driven stays over traditional urban hotels. Positioning these properties near natural landmarks also helps Marriott capture a niche market that’s often underserved by major chains.

Luxury hotels performed strongly with a 4% RevPAR increase in Q3. What’s fueling this demand for luxury accommodations?

The luxury segment’s success is driven by a combination of robust demand and strong rate performance. High-net-worth travelers and those seeking premium experiences are willing to spend more, especially post-pandemic, as they prioritize quality and exclusivity. This trend seems to be global, though certain regions like Europe and Asia-Pacific might be leading due to strong international tourism. Marriott’s ability to deliver exceptional service and unique offerings in their luxury properties keeps this segment thriving.

What’s your forecast for the future of the hospitality industry, particularly in terms of balancing growth and regional challenges?

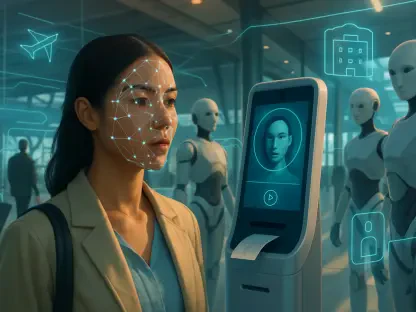

I think the hospitality industry will continue to see polarized growth, with international markets and luxury segments driving much of the momentum. However, companies like Marriott will need to address regional challenges, especially in mature markets like the U.S. and Canada, by innovating in product offerings and targeting underserved niches. Technology, such as AI-driven personalization, will also play a bigger role in enhancing guest experiences and operational efficiency. Overall, I’m optimistic, but adaptability will be key to navigating economic fluctuations and shifting traveler preferences.