Travelers increasingly expected a journey that behaved like a single, continuously updated service rather than a string of disconnected bookings, and this week’s moves showed suppliers responding in concert across flights, lodging, activities, and ground transport. The most striking thread tied once-separate functions together: AI shifted from novelty to navigation, payments fused with checkout and risk, and platform rebuilds prioritized scale and speed. That alignment mattered because it reframed the trip around intent and timing, not just inventory, letting brands act on first-party signals and context to shape what gets offered, when, and at what price. Taken together, these developments recast loyalty benefits, wellness tools, and local content as part of the core product, while back-office tasks like fraud screening and reconciliation moved into the foreground as conversion levers. The result pointed toward a travel stack that felt conversational, protective, and pre-arranged.

AI-Powered Personalization Moves Into the Trip Itself

AI stopped functioning like a content widget and started directing the experience in real time. City Sightseeing’s new app, built with iWander, blended a chat assistant, AI-guided walking tours, and an AI commerce layer that adjusted to a traveler’s location, interests, and changing conditions on the ground. After a London beta, a phased rollout continued globally through 2026, with the ambition to make destination discovery feel like a personal guide who knew opening hours, neighborhood vibes, and live operations. Major carriers pursued a similar shift. Delta introduced a Locals hub that surfaced itineraries and tips authored by residents, swapping out generalized city write-ups for street-level insight that translated to bookable choices. Meanwhile, United expanded its Timeshifter partnership, positioning circadian plans as a mainstream part of the airline journey rather than an optional afterthought.

The practical effect reached beyond inspiration. Timeshifter’s jet lag programs synced with MileagePlus status and miles earning, turning wellness into a loyalty differentiator that could influence pre-trip behavior and post-arrival recovery. That kind of integration suggested a broader discipline: content and AI not only informed decisions but also orchestrated them, shaping when travelers walked, rested, or rode. Crucially, the commerce element sat inside the same flow, where contextual prompts could propose a museum ticket, a skip-the-line pass, or a nearby attraction at the right moment. Across airlines and attractions, personalization turned into operations—updating routes, pushing alerts, and aligning offers with purpose. It marked a turn from pilots to production, where models had to be reliability-tested, localized, and embedded with inventory, not hosted in a sandbox.

Payments, Fraud, and Protection Become Product Features

The checkout screen became a strategic arena as providers rewired money movement, risk, and optional coverage into one fabric. Etraveli Group and Yuno connected a travel-tuned machine learning fraud engine to Yuno’s single API, letting merchants toggle high-specificity risk controls while accessing a catalog of more than a thousand payment methods across over two hundred countries. That approach aimed to lift approval rates without diluting defenses, aligning fraud strategy with revenue rather than treating it as an isolated compliance task. In lodging, Katanox and Selfbook stitched booking and settlement more tightly by enabling account-to-account payments, direct hotel connectivity, and real-time reconciliation—reducing card fees, chargeback exposure, and back-office delays, with Wyndham named among early adopters.

Consumer-facing protections widened in parallel, giving travelers more confidence to commit while keeping supplier revenue firm. Cloudbeds joined with Hopper Technology Solutions to bring Cancel for Any Reason to independent hotels’ direct channels, a move that preserved guaranteed income for properties while enabling resell of returned nights. Protect Group addressed a long-standing offline gap by launching an Agent Platform that allowed advisors to sell Refund Protect without any technical integration, a natural fit for segments like cruise where agent-led bookings dominated. These additions reframed ancillary sales as part of the promise of a trip that could flex when plans changed. The shared pattern was clear: payments architecture, risk mitigation, and coverage offers were designed into the booking journey, not appended later, and that embedding reduced friction while raising conversion and attachment rates.

Unified Platforms, Data, and Direct Demand

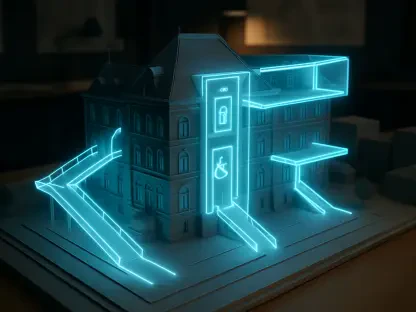

Behind the front-end polish, consolidation of tech stacks accelerated to support speed, SEO reach, and merchandising accuracy. HomeToGo completed the migration of Interhome onto its core platform, spanning 18 localized domains and more than 65,000 landing pages. The move capped an 18‑month carve-out and delivered a unified search experience with dynamic maps, streamlined checkout, and rebuilt SEO libraries engineered for peak-season discovery. A single stack also meant feature releases could ship faster, content could be governed consistently, and data could be activated across both B2C and B2B Pro channels without brittle handoffs. Elsewhere in short-term rentals, Casago appointed a chief digital officer to operate Vacasa.com as a direct-demand engine post-acquisition while setting an AI-first product roadmap, a signal that owning traffic, content, and pricing logic remained a priority.

Connectivity extended to the ground, where early planning often faltered. Amadeus integrated SmartRyde into Amadeus Transfers, letting agencies in Japan and South Korea book door-to-door airport rides at more than a thousand airports with live availability, instant confirmation, and upfront pricing. Coupled with airlines’ wellness layers and localized content, ground transport became yet another component pre-arranged inside a single workflow. Data activation rounded out the picture: Cloudbeds linked with Klaviyo to bring property and guest data into lifecycle messaging that could trigger timely promotions and nurture repeat stays. The path forward looked concrete and pragmatic: brands invested in unified stacks that simplified SEO and feature velocity, embedded risk and protection directly at checkout, expanded AI from advice to orchestration, and formalized ground integrations that turned a fraught handoff into a managed service. In doing so, the industry favored cohesion over point solutions and set clear milestones for the next tranche of releases.