In a world where travel is increasingly shaped by digital innovation, Klook, a prominent travel tech platform specializing in booking unique experiences and activities, is capturing global attention with its ambitious plan to launch a U.S. Initial Public Offering (IPO) targeting a $500 million raise at a potential valuation of $3 billion. This move is not just a financial milestone but a strategic leap into the heart of a rapidly evolving industry, fueled by post-pandemic recovery and a surge in demand for personalized travel solutions. Klook’s decision to list in the U.S., diverging from the more conventional Hong Kong market for Chinese companies, underscores its confidence in tapping American investor interest while aiming to expand its footprint beyond Southeast Asia. As the travel tech sector stands on the cusp of explosive growth, projected to soar from $15.5 billion currently to $23.9 billion by 2034, Klook’s bold strategy raises intriguing questions about its ability to carve out a leading role amidst fierce competition and complex market dynamics.

The Travel Tech Landscape and Klook’s Positioning

Market Growth and Opportunities

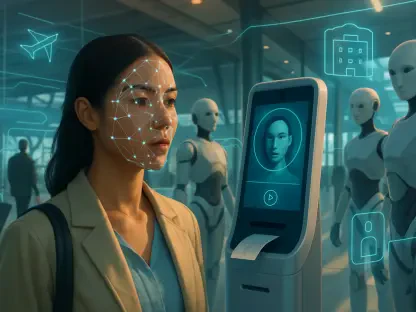

The travel tech industry is experiencing a remarkable surge, with forecasts indicating an expansion to $23.9 billion by 2034, driven by cutting-edge advancements like artificial intelligence (AI) and mobile-first booking platforms. Klook is strategically aligning itself with these trends, leveraging technology to meet the evolving needs of modern travelers. The company’s focus on seamless, user-friendly interfaces and data-driven insights positions it to capitalize on this upward trajectory. Beyond mere numbers, the sector’s growth reflects a broader shift toward digital solutions that prioritize convenience and customization, areas where Klook has already begun to make significant inroads. With an emphasis on innovation, the platform is not just riding the wave of industry expansion but actively shaping how travel experiences are curated and consumed in a tech-savvy world.

A key driver of Klook’s alignment with market opportunities lies in its targeted approach to younger demographics, particularly Gen Z and Millennials, who prioritize authentic and personalized travel experiences over traditional packaged tours. By offering tailored recommendations and culturally relevant activities, Klook taps into the preferences of these tech-savvy travelers who often rely on mobile apps and social media for trip planning. This demographic focus is bolstered by the company’s ability to integrate with popular platforms and leverage user-generated content, creating a sense of trust and community. As the demand for unique, experience-driven travel continues to rise among younger audiences, Klook’s strategic positioning ensures it remains a frontrunner in capturing this lucrative segment of the market, setting a foundation for sustained growth in a competitive landscape.

Demographic Trends and Market Fit

Beyond technological alignment, Klook’s success hinges on understanding and adapting to the cultural nuances that define travel preferences across different regions. The Asia-Pacific market, in particular, represents a critical growth area, with projections estimating a $5.0 billion travel tech market by 2032. Klook’s deep-rooted presence in this region, offering over 500,000 experiences across 2,700 destinations, showcases its commitment to hyper-localization. This strategy not only differentiates it from global competitors but also builds strong connections with local communities and tourism boards, ensuring offerings resonate with regional tastes. Such an approach is vital in a market where cultural relevance often determines consumer loyalty and engagement.

Additionally, Klook’s ability to cater to a global audience while maintaining a localized focus provides a unique competitive advantage in the travel tech space. The platform’s partnerships with local operators enable it to deliver authentic experiences that larger, less agile competitors might overlook. This balance of global reach and regional specificity is particularly appealing to investors looking for scalable yet grounded business models. As travel tech continues to evolve, Klook’s knack for blending broad market trends with targeted demographic strategies positions it as a compelling player in an industry ripe with opportunity, especially as consumer expectations shift toward more meaningful and personalized travel interactions.

Klook’s Competitive Edge

Innovation and Localization

At the heart of Klook’s appeal lies its innovative use of artificial intelligence to enhance user experience, reportedly boosting conversion rates by an impressive 30% through personalized recommendations and streamlined booking processes. This technological prowess allows the platform to stand out in a crowded market by anticipating traveler needs and offering tailored solutions, whether it’s a hidden cultural tour or a trending local activity. Unlike broader travel aggregators, Klook’s AI-driven approach focuses on precision, ensuring that users find experiences that match their interests with remarkable accuracy. This not only improves customer satisfaction but also drives operational efficiency, a crucial factor in maintaining profitability amidst rising competition in the digital travel space.

Equally significant is Klook’s commitment to hyper-localization, particularly in high-growth regions like Asia-Pacific and the Middle East, where it partners with local tourism entities to curate culturally relevant experiences. With a catalog of over 500,000 activities, the platform ensures travelers access unique offerings that reflect the essence of each destination, from street food tours in Bangkok to desert safaris in Dubai. These partnerships foster trust and authenticity, key elements that resonate with modern travelers seeking more than generic tourist traps. By embedding itself into the fabric of local economies and cultures, Klook not only differentiates itself from giants like Booking.com but also builds a loyal user base that values depth over breadth in travel planning, reinforcing its market position.

Financial Strength and Strategic Programs

Klook’s financial stability further solidifies its competitive standing, with profitability achieved in 2023 and a Gross Merchandise Value (GMV) of $3 billion, backed by prominent investors such as SoftBank and Vitruvian Partners. This fiscal health provides the company with the resources to invest in innovation and market expansion while weathering potential economic downturns. Such backing also signals confidence from the investment community in Klook’s business model, which balances growth with cost efficiency. This financial foundation is a critical asset as the company navigates the complexities of a U.S. IPO, offering reassurance to potential shareholders about its long-term viability in a volatile industry.

Another pillar of Klook’s edge is its strategic initiatives like the Kreator program, which engages over 20,000 content creators to promote travel experiences through social commerce platforms such as TikTok. This approach taps into the $5.5 billion mobile travel app market by leveraging user-generated content to influence younger demographics who prioritize authenticity in their travel decisions. By integrating social media trends with booking capabilities, Klook creates a seamless journey from inspiration to transaction, setting itself apart from competitors who rely on traditional marketing. This forward-thinking strategy not only enhances brand visibility but also aligns with how modern travelers discover and choose experiences, positioning Klook as a trendsetter in the digital travel ecosystem.

Strategic Ambitions and Risks

U.S. Listing and Expansion

Klook’s decision to pursue a U.S. IPO, rather than a more conventional listing in Hong Kong, represents a bold strategy that highlights its ambition to attract American investors and gain visibility on a global stage. This move reflects a calculated bet on the strong appetite for travel tech investments in the U.S., where investors are keen on innovative, high-growth sectors. By listing stateside, Klook aims to fund its expansion into North American and European markets, regions that present untapped potential but also distinct challenges compared to its established Southeast Asian base. This bold step signals the company’s intent to evolve from a regional leader into a global contender, leveraging the prestige and capital access of a U.S. listing to fuel its international aspirations.

However, scaling into new territories like North America and Europe is fraught with complexities that test Klook’s adaptability. Consumer preferences, regulatory landscapes, and competitive dynamics in these markets differ significantly from Asia-Pacific, requiring tailored strategies to replicate past successes. The challenge lies in maintaining the hyper-localized approach that has worked so well in Asia while addressing the diverse needs of Western travelers who may prioritize different aspects of travel planning. Success in these regions will depend on Klook’s ability to balance global standardization with regional customization, a delicate act that could determine whether its international expansion strengthens or strains its operational model in the long run.

Potential Challenges and Valuation Concerns

Despite the optimism surrounding Klook’s IPO, significant risks loom on the horizon, including regulatory scrutiny that varies widely across markets and could impact operational freedom. Macroeconomic volatility, such as inflation or geopolitical tensions, poses additional threats to consumer spending on travel, potentially dampening demand for Klook’s offerings. Moreover, the competitive landscape remains intense, with established players like Expedia and Trip.com wielding substantial resources to defend their market share. These external pressures, combined with the inherent uncertainties of entering new regions, underscore the need for Klook to maintain strategic discipline and agility to mitigate potential setbacks that could affect investor confidence.

Valuation concerns also cast a shadow over Klook’s IPO prospects, with the risk of overpricing drawing parallels to past high-profile cases tied to SoftBank, a key investor. While Klook’s projected Price-to-Sales (P/S) ratio of below 3x appears attractive compared to Booking.com at 5x and Expedia at 4.5x, any misstep in pricing could lead to post-listing corrections, eroding shareholder value. Investors are advised to closely monitor the IPO’s execution, as disciplined pricing will be crucial to sustaining long-term interest. Balancing growth expectations with realistic valuations will be a defining factor in whether Klook’s U.S. debut is seen as a triumph of strategic foresight or a cautionary tale of overambition in a competitive sector.

Reflecting on a Pivotal Moment

Looking back, Klook’s journey to a U.S. IPO stood as a defining chapter in the travel tech narrative, encapsulating the industry’s shift toward digital innovation and personalized experiences. The company’s achievements, from reaching profitability in 2023 to amassing a $3 billion GMV, highlighted its resilience and vision. Yet, the challenges of regulatory landscapes, fierce competition, and market expansion painted a nuanced picture of risk alongside opportunity. For stakeholders, the next steps involved closely watching how Klook navigated its international growth, particularly in adapting its localized model to new regions. Investors were encouraged to prioritize data-driven decisions, focusing on valuation metrics like the P/S ratio to assess long-term value. As the travel tech sector continued to evolve, Klook’s ability to innovate while maintaining financial discipline offered a blueprint for others, shaping discussions on how technology could redefine travel in the years ahead.