In an industry where seamless connectivity and tailored solutions are paramount, the recent acquisition of ATPI by Direct Travel, Inc. stands as a defining moment, handling over $6 billion in annual travel volume. This merger has not only created one of the largest global travel management entities but also signals a seismic shift in how corporate, leisure, and specialized travel sectors are navigated. With businesses increasingly demanding agile, technology-driven travel solutions, this strategic union offers a lens into emerging market trends and competitive dynamics. The purpose of this analysis is to dissect the implications of this powerhouse formation, focusing on its impact on market positioning and client expectations.

The travel management sector has been under intense pressure to adapt to globalization, digital transformation, and niche market demands. This acquisition serves as a critical case study for understanding how consolidation can address these challenges while redefining service delivery on a worldwide scale. By examining the combined strengths of Direct Travel and ATPI, this analysis aims to uncover actionable insights for stakeholders navigating an increasingly complex landscape.

This market evaluation will delve into current patterns, project future trajectories, and assess how this merger positions the new entity against mega-agencies. The focus will span global reach, technological innovation, and specialization in high-demand industries, providing a comprehensive view of what this means for the broader travel ecosystem.

In-Depth Market Analysis: Trends, Data, and Projections

Expanding Global Footprint: A Competitive Edge

The merger significantly bolsters the global presence of the combined entity, blending Direct Travel’s robust North American foundation with ATPI’s extensive international network. This strategic alignment enables unparalleled service delivery across diverse geographies, catering to multinational corporations and localized businesses alike. Market data indicates that firms with such expansive reach can capture a larger share of the $1.5 trillion global business travel market, especially as cross-border operations grow. This positions the new entity to challenge larger competitors by offering a more responsive and personalized approach.

Beyond sheer scale, the integration of regional expertise allows for a nuanced understanding of cultural and regulatory differences in travel management. For instance, navigating compliance in the European Union versus Asia-Pacific markets requires tailored strategies, which this merger facilitates through shared resources. However, the challenge lies in harmonizing operational standards across regions to ensure consistency, a factor that will determine long-term success in maintaining client trust.

Analysts project that over the next few years, from 2025 to 2028, the demand for integrated global travel solutions will surge by approximately 15%, driven by economic recovery and hybrid work models. Companies that can offer seamless connectivity across time zones will likely dominate, making this expanded footprint a critical asset for capturing emerging opportunities in underserved markets.

Technology as a Market Differentiator

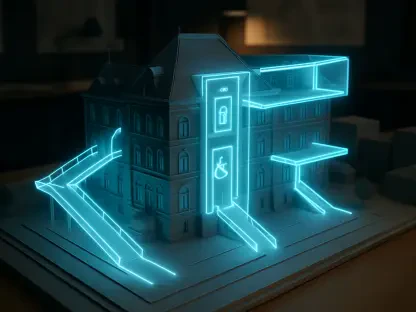

A pivotal element of this acquisition is the accelerated deployment of Avenir Travel Edition, a state-of-the-art platform engineered to enhance business travel experiences through real-time data and user-centric design. In a market where digital tools are becoming indispensable, this technology sets the merged entity apart by providing travel managers with actionable insights and fostering stronger supplier relationships. Compared to legacy systems, such platforms reduce booking errors by up to 30%, based on industry benchmarks, signaling a transformative potential for operational efficiency.

The broader trend toward digitalization in travel management underscores the importance of such innovations. With corporate clients prioritizing data transparency for cost control and risk management, platforms that integrate analytics and automation are gaining traction. The risk, however, lies in cybersecurity vulnerabilities, as increased reliance on tech solutions necessitates robust safeguards to protect sensitive client information.

Looking ahead, market projections suggest that by 2027, over 60% of travel management companies will adopt similar tech-driven models to remain competitive. The early adoption and international rollout of advanced tools by this new entity could establish a significant lead, provided continuous updates and user training are prioritized to maximize adoption rates among diverse client bases.

Niche Market Specialization: Unlocking Unique Value

Another key market trend amplified by this merger is the focus on specialized industries such as energy, marine, sports, and mining, which have distinct travel logistics and safety requirements. ATPI’s established expertise in crafting bespoke solutions for these sectors, supported by proprietary technology, offers a competitive edge in a segment often overlooked by larger agencies. Industry reports highlight that niche-focused travel management can yield client retention rates exceeding 80%, far above the general market average.

This strategic emphasis allows the combined entity to address complex challenges, such as coordinating offshore crew rotations or managing event logistics for international sports teams. Such specialization not only builds loyalty but also creates barriers to entry for competitors lacking deep industry knowledge. The planned investment in expanding these capabilities signals an intent to double down on high-margin, high-demand sectors.

Future market analysis indicates that specialization will become a defining factor in travel management differentiation over the next decade. As global supply chains and event industries rebound, firms equipped to handle unique operational needs will likely see disproportionate growth, positioning this merger as a forward-thinking move to capture untapped potential in these areas.

Strategic Reflections and Industry Implications

Reflecting on the market analysis, the union of Direct Travel and ATPI marks a pivotal shift in the travel management landscape, redefining competitive benchmarks through enhanced global reach, technological innovation, and niche expertise. The findings underscore how strategic consolidation can address pressing industry challenges, from digital disruption to specialized client demands. This merger sets a precedent for balancing scalability with personalized service, offering a blueprint for others in the sector.

For industry stakeholders, the implication is clear: adaptability and investment in cutting-edge tools are non-negotiable for staying relevant. Travel managers and businesses are encouraged to align with providers capable of delivering integrated, data-driven solutions tailored to specific needs. A critical next step involves monitoring how this new entity navigates integration challenges, as successful execution could inspire similar mergers.

Looking ahead, the broader takeaway is the need to anticipate evolving market dynamics, particularly around sustainability and regulatory compliance. Companies are advised to explore partnerships that enhance their capacity for innovation while maintaining a client-centric focus. This transformative moment in travel management history prompts a reevaluation of strategies, urging all players to rethink global connectivity and service excellence as core priorities.