Imagine a bustling summer day at a major European airport, with travelers streaming through terminals, eager for international getaways, yet despite the apparent energy, the latest data reveals a surprising truth. Passenger traffic across more than 470 European airports grew by only a modest 3.1% in July of this year. This figure, while positive, raises questions about the pace of aviation recovery during a peak travel month. This roundup gathers perspectives from industry analysts, airport operators, and airline stakeholders to unpack what this subdued growth means for European air travel, exploring regional disparities, market dynamics, and future strategies.

Unpacking the Numbers: What Experts Are Saying

Industry observers note that the 3.1% growth in passenger traffic, though indicative of progress, falls short of historical summer peaks. Analysts highlight that international travel, surging by 3.7%, remains the primary driver of this uptick, while domestic travel lags significantly with a mere 0.7% increase. This split suggests that global connectivity is fueling recovery, but challenges like economic constraints are stifling shorter-haul demand within countries.

Another point of consensus among experts is the underwhelming performance compared to earlier months. With passenger traffic for the first half of the year up by a stronger 4.5%, many industry voices express concern over the slowdown during a critical season. Some suggest that airlines are adopting a cautious approach to capacity, as evidenced by a parallel 2.9% rise in flight operations, reflecting a deliberate balance between demand and supply in an uncertain economic climate.

A differing view emerges from a segment of analysts who see this modest growth as a sign of stabilization rather than stagnation. They argue that surpassing pre-pandemic levels by 5% is a noteworthy achievement, pointing to resilience in the sector. However, they caution that without targeted interventions, such as boosting domestic routes, the recovery risks becoming lopsided, overly reliant on international markets.

Regional Divides: Contrasting Opinions on Performance Gaps

When it comes to regional performance, insights from various stakeholders reveal a stark divide. In the EU+ market, which includes the EU, EEA, Switzerland, and the UK, growth averaged 2.8%, with standout performers like Poland and Cyprus posting double-digit gains. Aviation consultants attribute this to robust tourism demand, but they also note underperformance in mature markets like Germany and the UK, where saturation appears to limit expansion.

Outside this zone, non-EU+ regions reported a stronger 4.7% growth, with countries like Moldova achieving a remarkable 45% increase. Industry commentators link this to emerging market dynamics and improved connectivity. However, declines in areas such as Russia, down by 15.1%, prompt warnings from geopolitical analysts about the impact of tensions on travel flows, suggesting that recovery remains fragile in certain areas.

Opinions diverge on how to address these disparities. While some experts advocate for increased investment in underperforming western markets to stimulate demand, others argue that the focus should shift toward capitalizing on growth in eastern and central regions. This debate underscores the challenge of crafting a unified strategy for a continent with such varied aviation landscapes.

Airport Size and Growth: Surprising Takes from the Field

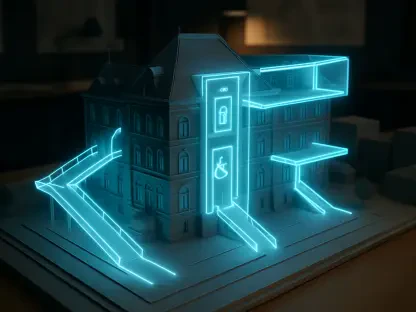

A striking trend noted by airport operators is the outperformance of smaller hubs. Small airports, handling under 1 million passengers annually, grew by 4%, with some like Kiruna in Sweden skyrocketing by over 160%. Managers of these facilities credit low-cost carriers and niche leisure travel for fueling this surge, seeing it as an opportunity to carve out specialized markets.

In contrast, mega airports, those handling over 25 million passengers, grew at a slower 2.7%, with giants like London Heathrow showing flat results. Industry leaders from larger hubs express skepticism about the sustainability of smaller airports’ gains, suggesting that their growth may be a temporary boost driven by budget airlines rather than a long-term shift. They emphasize the need for infrastructure investments to maintain competitiveness at major gateways.

A third perspective comes from airline strategists, who see potential in balancing operations between large and small airports. They recommend that carriers diversify routes to include more regional destinations, tapping into the visiting-friends-and-relatives travel segment. This approach, they argue, could distribute growth more evenly while alleviating pressure on saturated major hubs.

Strategic Implications: Tips from Industry Insiders

Turning to actionable insights, aviation consultants advise airports and airlines to prioritize international leisure routes, given their dominance in driving traffic. Tailoring marketing campaigns to highlight unique destinations in high-growth regions could attract more cross-border travelers, especially in markets showing double-digit increases.

Another tip from operational experts focuses on enhancing regional connectivity, particularly for smaller airports. By fostering partnerships with low-cost carriers, these hubs can sustain momentum and build on current gains. Additionally, they suggest that digital tools for capacity planning could help align flight schedules with fluctuating demand patterns, avoiding overextension during peak periods.

A final piece of advice from economic analysts centers on adapting to uneven recovery. They recommend that stakeholders conduct detailed market studies to understand local challenges, whether it’s economic slowdowns in mature markets or geopolitical barriers elsewhere. Customizing strategies to address specific regional dynamics, they assert, will be key to navigating the complexities of the current landscape.

Wrapping Up the Discussion

Looking back, this roundup of perspectives on European airports’ modest 3.1% growth in July paints a multifaceted picture of recovery. Industry voices agreed on the strength of international demand and the unexpected rise of smaller hubs, but differed on whether the slowdown signaled caution or stabilization. The regional divide further highlighted the uneven nature of progress, with robust growth in some areas juxtaposed against declines in others.

Moving forward, stakeholders can take concrete steps by focusing on data-driven route planning and fostering collaborations to boost connectivity in emerging markets. Exploring innovative partnerships with budget airlines for smaller airports could also unlock new opportunities. As the aviation sector continues to evolve, keeping a close eye on shifting traveler preferences and regional trends will be essential for sustained advancement.